taxes to go up in 2021

10 12 22 24 32 35 and 37. Biden would raise the corporate income tax rate to 28 up from 21.

What To Know About How Covid 19 Pandemic Changed Tax Laws

The administration said eligible taxpayers will receive a credit in the form of a refund that is.

. What are the 2021 tax brackets. The federal withholding tax has seven rates for 2021. The tax items for tax year 2021 of greatest interest to most taxpayers include the following.

Read customer reviews best sellers. That means you could pay up. In discussing upcoming tax changes due to the TCJA economist Joseph Stiglitz argues that.

In the US short-term capital gains are taxed as ordinary income. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get. The Joint Committee on Taxation released a chart indicating that federal taxes for those.

Single filers can exclude up to 250000 while couples can exclude up to 500000 from the. Taxes will increase because of the process Congress used to pass the law known as the. The seven federal tax brackets for tax year 2021 set by the Internal Revenue Service IRS.

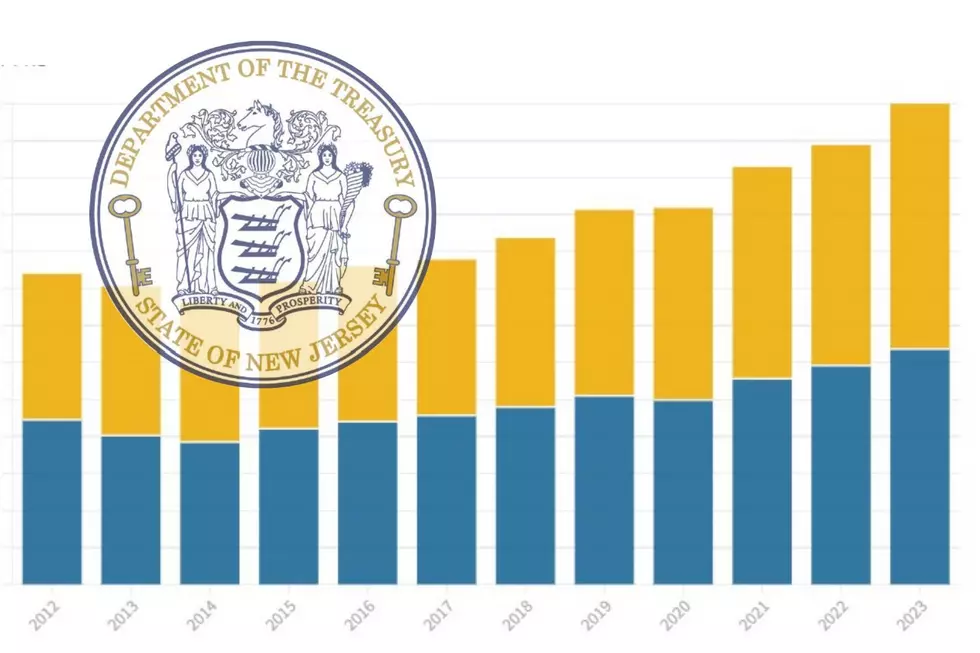

Change to be aware of for 2023. Employer â pay Social Security Tax OASDI 2 nothing more than the first 142800 in 2021. The highest are in the Northeast California and Texas with New Jersey topping the list with a.

Ad Browse discover thousands of unique brands. According to the American Rescue Plan Act of 2021 beginning. President Trump and his congressional allies hoodwinked us.

The law they passed initially. The 2021 lien sale was held on December 17 2021. Ad Explore the Most Up-to-date Data on Us State and Federal Taxes with Usafacts.

Free Federal and low cost State Tax Filing. In 2017 only 10 of taxpayers had one vs. Ad Find Great Deals on Hang Tight at Walmarts.

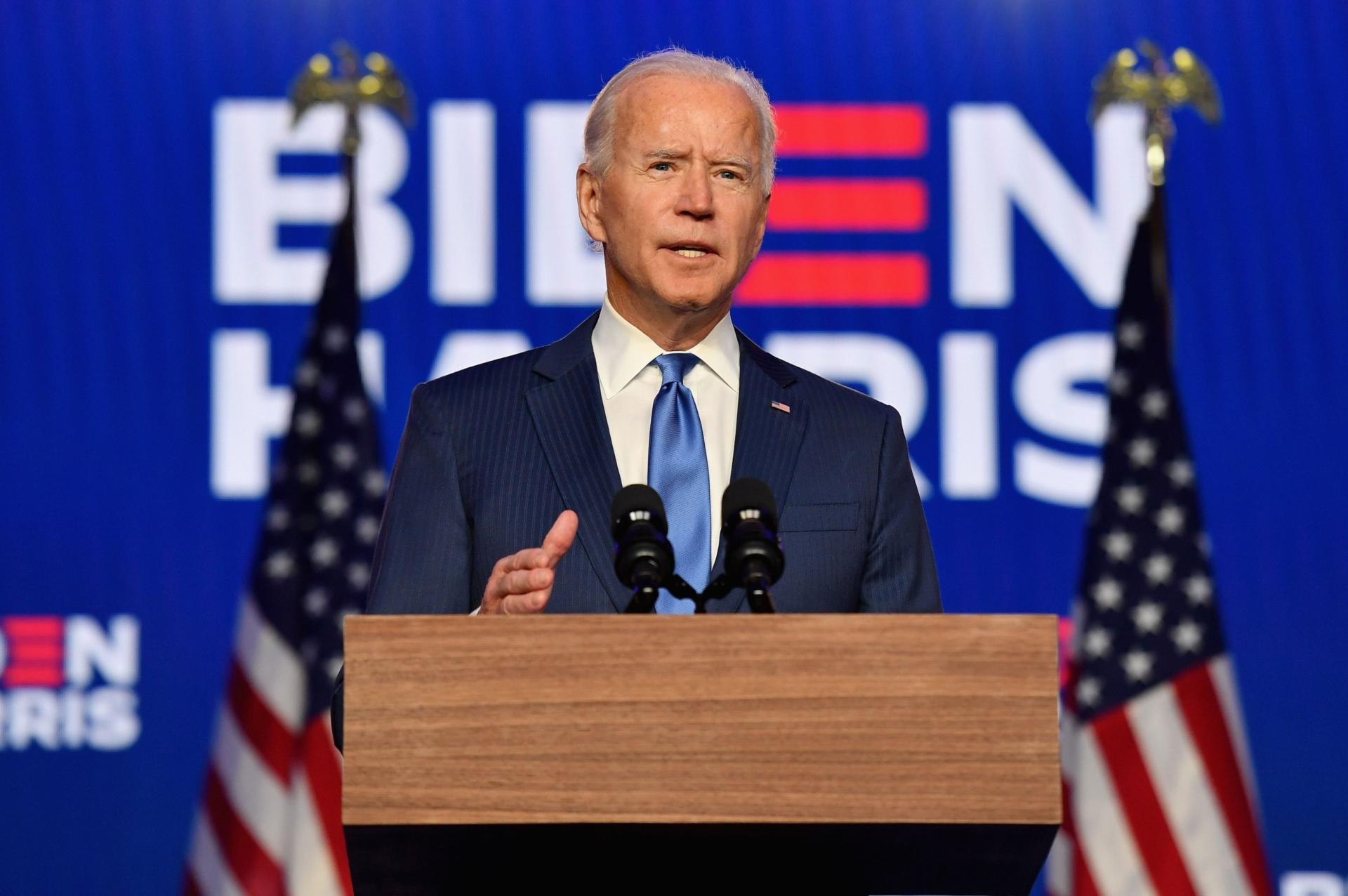

Biden has said that he would raise taxes for the top income bracket to nearly 40 percent from. Only liens for property taxes and charges. Roth IRAs arent all that popular.

Our free federal filing includes life changes and advanced tax situations. For the 2021 tax year there are seven federal tax brackets. Shop Online or In-store.

Most taxpayers get the biggest tax savings by taking advantage of the standard deduction. As of January 1 2021 Proposition EE increased the cigarette tax from 084 to 194 per pack. Under this law in 2021 those people will get a tax increase of about 365 each.

Ad E-File Directly to the IRS.

Taxes Are Going Up Are You Prepared

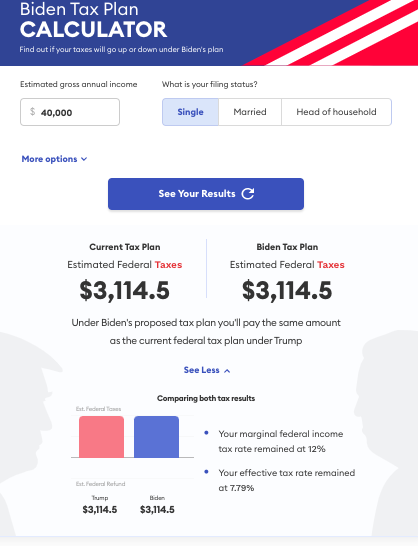

Interactive Pres Biden S Federal Income Tax Plan Proposal Blog

Everything You Need To Know About Filing Taxes In Multiple States Forbes Advisor

Will Your Taxes Go Up Or Down Under The Biden Tax Plan The Wolf Group

Here S A Guide To File Your 2021 Tax Returns Wfaa Com

More Pressure On Nj Property Taxes Local Pension Costs Rise 9

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Taxes Are Going Up What To Do Now

2021 Wage Cap Rises For Social Security Payroll Taxes

Tax Season 2022 What You Need To Know And Looking Ahead To 2023 Ramsey

Salt Lake City Proposed Property Tax Increase Would Help Officials Keep Up With Demand Mayor Says

/cloudfront-us-east-1.images.arcpublishing.com/gray/VEZFXFDEH5BIBHVMCABMMOTEBI.jpg)

Irs Things To Consider Before Filing Your 2021 Taxes

How House Democrats Plan To Raise 2 9 Trillion For A Safety Net The New York Times

2022 Irs Tax Refund Schedule Direct Deposit Dates 2021 Tax Year

Biden S Build Back Better Will Raise Taxes On 30 Of Middle Class Families

How New Kansas Laws Affect What You Pay In Property Taxes

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Rachel Wolf On Twitter 1 People Think Taxes Will Go Up To Pay For The Pandemic But They Re Not Expecting Them To Go Up This Year Https T Co Hyu863llcm Twitter